Choosing a program that offers the best terms for your client is challenging. Today, we compare two options – VA loans, available to military members, and conventional loans, backed by Fannie Mae and Freddie Mac – and explore the differences between them in detail.

This article will help you clearly understand which program works best in different situations. Moreover, it provides short answers to your client’s common questions on which one to choose – a VA loan or a conventional loan?

Quick Answer: When Each Option Wins

There are several basic considerations to keep in mind when comparing these two options:

- VA loans are a perfect choice for eligible individuals purchasing a primary residence with no down payment or Private Mortgage Insurance (PMI) and with lower interest rates. Note that the loan terms still require a one-time funding fee.

- Conventional loans work best when the borrower is purchasing a second home or an investment property and can make a 20% down payment to skip PMI. Also, some people generally prefer non-VA terms because they offer greater flexibility in structuring seller concessions and don’t use up any of the borrower’s VA entitlement.

- While borrowers with full entitlement have no VA loan limits, conventional loan amounts are limited by the FHFA. In 2025, the maximum baseline is $806,500 for one-unit properties in most states, excluding high-cost areas such as Hawaii.

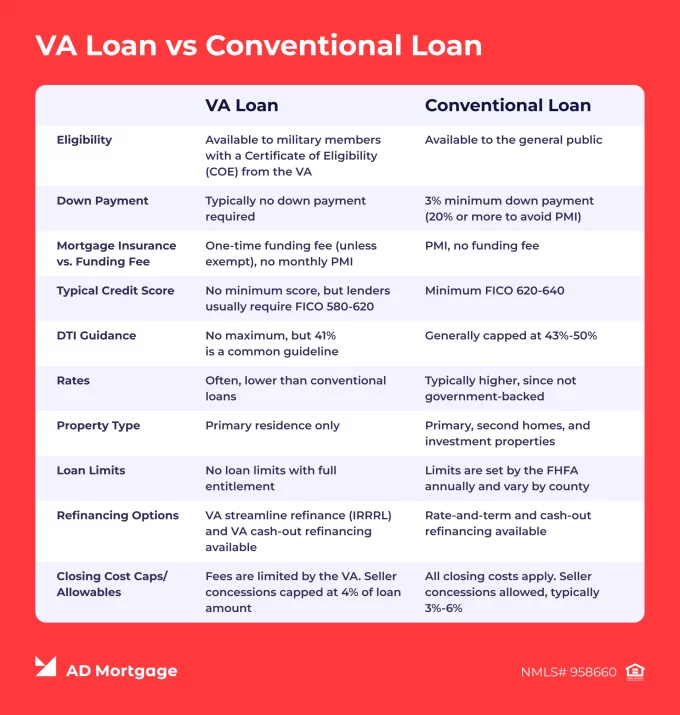

VA vs Conventional: Side-by-Side (2025)

VA loans and conventional loans differ significantly in numerous important ways, including down payment, credit scores, loan limits, and property types. We have created a clear side-by-side comparison table so that you can easily see the differences and confidently explain them to your clients in simple terms.

When a VA Loan is Better

VA loans are offered by the Department of Veterans Affairs (VA) to support military members and their surviving spouses in becoming homeowners. VA loan terms are attractive and work best when the borrower wants to:

- Make no down payment

- Avoid PMI

- Purchase a primary residence

- Have flexible VA loan credit score requirements

Additionally, VA loans allow refinancing through the VA IRRRL (Interest Rate Reduction Refinance Loan). This way, the borrower can lower the interest rate with minimal documentation needed and with the funding fee as small as 0.5%.

Broker Tip: Check the Certificate of Eligibility (COE) for any exemptions early to help your client avoid paying the funding fee.

When a Conventional Loan is Better

Conventional loans are mortgages that are not insured or guaranteed by government agencies. Instead, they are offered by private lenders and therefore typically offer better loan term flexibility.

In comparison to VA loans, conventional loans might be beneficial in these three scenarios:

- The borrower can make a 20% or larger down payment to avoid paying monthly PMI and a one-time funding fee.

- The borrower is purchasing a second home or an investment property.

- The borrower wants more flexibility, for example, in terms of property condition or occupancy.

Real-World Cost Snapshot

The difference is clearly seen in this example. Note that this scenario is hypothetical and can be used for illustrative purposes only. For exact loan terms, please consult your lender.

Loan Scenario:

- $250,000 loan amount

- Primary residence

- Loan term: 30 years

- Down payment for conventional loan: 5%

- Interest rates for both loans: 6%

| Loan Type | Upfront Costs | Monthly Costs | Total Costs over 5 Years | Notes |

|---|---|---|---|---|

| VA Loan | $0 down + $1,250 funding fee + $3,500 closing costs | $1,500 PITI | $94,750 | Funding fee and closing costs can be rolled into the loan. Additionally, a VA IRRRL can help lower interest rates. |

| Conventional Loan | $12,500 down + $5,000 closing costs | $1,725 PITI + PMI | $121,000 | Closing costs can be rolled into the loan. Monthly PMI payments end when the home equity reaches 20%. |

Over the course of five years, VA loans prove to be almost $30,000 more cost-effective, but there are trade-offs to consider:

- VA loans offer lower upfront costs, but the funding fee slightly increases loan balance. However, an IRRRL in the future can improve the loan terms by reducing interest rates.

- Conventional loans typically come with higher closing costs, down payment and monthly payments. However, PMI is eliminated when home equity is over 20%.

Generally, VA loans are the preferred option, but conventional loans can be more cost-effective over the long term, depending on overall loan terms.

A&D Mortgage Programs You Can Use Now

A&D Mortgage is an experienced mortgage lender that offers numerous programs to help people with different backgrounds purchase a home. For those who are choosing between VA loans and Conventional loans, there are several programs available:

- Loan amounts up to $2 million

- Minimum FICO score of 580

- Up to 100% LTV

- Owner-occupied property

- Manufactured homes eligible

- COE required

- Streamlined refinance option for an existing VA loan

- Loan amounts up to $1.5 million

- Minimum FICO score of 580

- Up to 110% LTV

- Manufactured homes eligible

- Conventional Standard with flexible down payments starting at 3%

- Conventional High Balance for larger loans on properties in expensive areas

- Fannie Mae RefiNow and Freddie Mac Refi Possible to refinance existing loans

- Fannie Mae HomeReady and Freddie Mac Home Possible for low- and moderate-income borrowers

In addition to these programs, A&D Mortgage offers other options. Consider Non-QM alternatives such as Bank Statement loans, DSCR loans, Asset Utilization loans, or Prime Jumbo loans (up to $3.5 million) for unique income or property scenarios.

FAQ: VA Mortgage vs Conventional Mortgage

Is VA or Conventional cheaper long term?

While VA loans are typically more cost-effective in the short-term, conventional loans might be cheaper in the long run. However, that depends on the loan terms, home equity, down payment size, and other factors.

Can I Buy a Duplex with VA and Live in One Unit?

Yes, the borrower can purchase a multi-unit home with up to four units but living in one of them is required.

What’s the 2025 Conforming Loan Limit?

The conforming loan limits in 2025 have experienced a 5.2% increase from 2024 and now are $806,500 for most U.S. states. However, in expensive areas like Hawaii, the limits are higher.

Can I Use VA for a Second Home or Investment?

As a general rule, VA loans are allowed for purchasing a primary residence only. The borrower needs to move into the new house within 60 days after the closing date.

Do VA Loans Require PMI?

No, VA loans do not require any ongoing mortgage insurance, including PMI.

Key Takeaways

- VA loans are a go-to option for eligible borrowers who want to avoid down payment and PMI and seek lower interest rates on primary residences.

- Conventional loans are a better choice for borrowers who can make a down payment (over 20% down help avoid paying PMI) and purchase second homes or investment properties.

- A&D Mortgage offers VA Standard, VA IRRRL, Conventional, and Non-QM programs – use our Quick Pricer to compare terms in minutes.

Conclusion

Whether your client prefers the favorable conditions of VA loans or flexibility of conventional loans, you will need to quickly and accurately guide them through the mortgage process. To assist you, we have created AIM, an improved Partner Portal that blends the power of Artificial Intelligence with a personal approach.

Register on AIM to benefit from a free broker CRM, 24/7 support, learning center, and other industry-tailored tools.