Many borrowers don’t fit into traditional loan requirements due to self-employment, purchasing properties such as non-warrantable condos, or having unconventional income or credit situations. In such cases, borrowers often ask, “What is a Non-QM loan?” It’s a broker’s role to educate clients in order to match them with the mortgage solution that best fits their needs.

Let’s explore common Non-QM loan requirements, the pros and cons of these mortgages, and the types of borrowers who can benefit most.

Quick Summary for Brokers

- A Non-QM loan is a mortgage option that offers more flexible requirements compared to traditional lending, allowing borrowers with alternative income documentation or nonstandard credit profiles to qualify.

- Non-QM loans still require full underwriting to ensure the borrower has the ability to repay (ATR) and can afford the mortgage.

- Brokers should present Non-QM loans as an alternative qualification option and set realistic expectations regarding timelines and costs.

Non-QM Mortgage Is More Flexible

While a qualified mortgage (QM) complies with strict Consumer Financial Protection Bureau (CFPB) standards, a non-qualified mortgage (Non-QM) offers more flexible underwriting rules. Therefore, Non-QM loans help borrowers who don’t fit traditional guidelines still obtain a mortgage.

It’s important to note that Non-QM loans are not subprime or ‘no-doc’ loans. They just offer additional ways for borrowers who can afford homeownership to achieve it through alternative qualification methods.

What Makes a Loan “Non-QM”?

When comparing QM and Non-QM programs, both are fully legal mortgage options. Unlike QM loans, Non-QM loans do not meet at least one CFPB criterion, but they still require full underwriting and sufficient documentation.

Non-QM loans are not about higher risk, and lenders must still evaluate the borrower’s financial profile. These loans are also required to follow ability-to-repay (ATR) rules, ensuring the borrower can pay back the mortgage.

Although they allow alternative ways to qualify, this does not mean reduced documentation. The alternative methods typically include bank statements, asset-based qualifications, and alternative income calculations.

Why Non-QM Loans Exist

Traditional mortgage requirements were created for predictable income patterns. Over time, borrower profiles have become more complex, including self-employment, freelance work, investment income, or irregular payments.

This complexity can make it difficult to evaluate a borrower’s real-world cash flow and repayment ability. As a result, some borrowers may not qualify under traditional guidelines, even if they are financially stable.

With Non-QM loans, brokers can offer their clients flexible qualification options and keep deals moving efficiently.

Who Typically Uses Non-QM Loans?

The following borrower profile/scenario overview helps brokers quickly understand which clients can benefit from Non-QM loans and match them with the program that best fits them.

- Self-Employed / Variable Income. Borrowers who run a business or work freelance may not be able to provide a W-2 form. Nonetheless, they might be financially stable and have sufficient earnings. In these cases, alternative documentation (alt-doc) such as bank statements can help demonstrate the borrower’s repayment ability and better reflect their income.

- Strong Assets but Nontraditional Income Profile. Borrowers with seasonal income or investors affected by tax deductions may have sufficient income and assets, but their earnings may not appear conventional on paper. Non-QM loans allow lenders to consider assets and reserves as part of the qualification process.

- Recent Credit Event. Borrowers who have experienced bankruptcies or foreclosures may not be automatically declined and can still qualify for a Non-QM loan. However, they must still undergo full underwriting and meet ATR requirements.

- Complex Income Streams. When a borrower has multiple income sources and earnings that vary month to month, traditional calculations may underestimate their repayment capacity. With Non-QM programs, borrowers with side businesses, royalties, or gig work can present a clearer picture of their overall income.

- Unique Property or Circumstance. Each case is different, and Non-QM loans provide options for those who don’t fit traditional mortgage guidelines. For example, borrowers purchasing nontraditional properties, such as non-warrantable condos or investment properties, may still be eligible for financing.

How Does It Work?

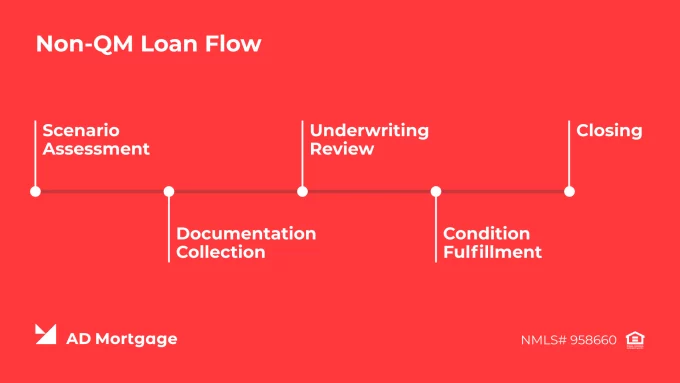

Typically, the Non-QM workflow consists of five steps:

- Scenario Assessment. The broker evaluates the borrower’s profile – including income, assets, credit history, and property details – to determine whether this loan can be helpful in the particular situation. Then, the broker chooses a qualification approach and detects potential challenges to set realistic expectations regarding timelines and conditions.

- Documentation Collection. The broker gathers the documentation required for the chosen loan scenario. This typically includes bank statements, alternative income records, asset statements, or other supporting documents, all of which must be complete and accurate.

- Underwriting Review. The documentation is submitted to the lender for examination. The lender evaluates the borrower’s ability to repay the loan and reviews the profile as a whole, rather than following a strict QM formula.

- Condition Fulfillment. After the initial review, the borrower typically receives conditional approval that requires additional action before final approval. This might include providing extra documentation or verifying income sources. At this step, the broker coordinates the required actions and guides the borrower through the process to keep the loan moving efficiently.

- Closing. Fulfilling conditions moves the loan to approval and the final stage – closing. Mortgage documents are signed, and funds are disbursed in accordance with standard closing procedures.

Broker Tip: Understanding all steps in detail ensures a smooth process. It also helps set realistic expectations for the borrower. Additionally, preparing documentation in advance and communicating proactively with the lender can prevent delays and keep the loan moving efficiently.

Common Non-QM Requirements

Although exact criteria vary by lender and program, there are several common requirements. These are the key elements that lenders typically look at when reviewing a borrower’s profile:

- Credit Score. The borrower needs to have a strong credit profile and demonstrate on-time payments and responsible debt management. Generally, lenders require a FICO of 620 or higher, though lower scores may be considered when supported by strong compensating factors.

- Down Payment. Typically, lenders require a larger down payment for Non-QM loans, often ranging between 10% and 20%, compared to many conventional options. However, the size of down payment largely depends on the credit score and overall financial profile.

- Reserves and Compensating Factors. Reserves are the funds that the borrower has left on hand after closing, such as savings or investment accounts. Lenders evaluate them to ensure the borrower can meet loan obligations and handle unexpected expenses. Compensating factors are strengths in the borrower’s profile, such as high reserves, larger down payments, or a low debt-to-income (DTI) ratio. Brokers should identify and highlight these factors early to select the most appropriate qualification strategy.

- Documentation. Non-QM loans allow alternative documentation, such as bank statements to verify income and cash flow, asset statements to assess savings and financial stability, and profit-and-loss statements for businesses.

Pros and Cons of Non-QM Loans

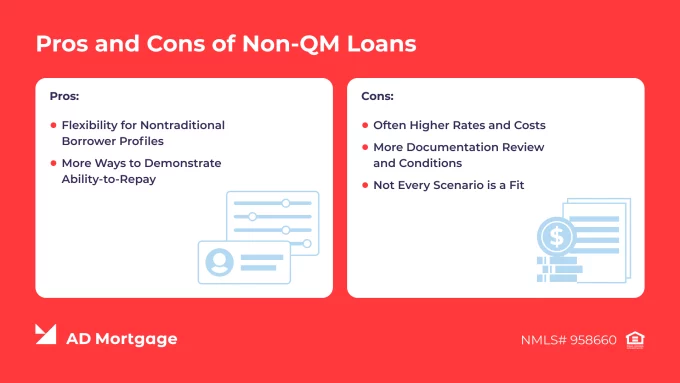

Despite being a great tool, these loans also have their limitations. It is crucial to understand the potential challenges of these mortgages and explain them clearly to their clients.

Pros

- Flexibility for Nontraditional Borrower Profiles. Those who don’t fit standard QM guidelines but have the financial ability to afford a mortgage may qualify under Non-QM requirements. This creates opportunities for self-employed individuals, investors, gig workers, and others to obtain financing structured around their income profile.

- More Ways to Demonstrate Ability-to-Repay. Non-QM loans allow alternative documentation rather than relying solely on W-2s and tax returns. This approach can better reflect a borrower’s true financial situation.

Cons

- Often Higher Rates and Costs. Compared to QM loans, Non-QM loans generally carry higher interest rates and sometimes higher fees. These costs are associated with greater complexity of underwriting and perceived lender risk.

- More Documentation Review and Conditions. Due to more detailed review and potential additional verifications or explanations, Non-QM loans might come with extended timelines. Commonly, closing time for these ranges from 30 to 60 days, depending on lender guidelines and broker preparation.

- Not Every Scenario is a Fit. While Non-QM loans are a flexible solution, they are not universal. Brokers must carefully pre-evaluate each borrower’s profile to ensure it meets program requirements.

How Brokers Position Non-QM the Right Way

They can be a valuable tool in a broker’s portfolio, but success depends on proper positioning.

First, brokers should set realistic expectations and clearly explain the nuances of these loans. Present them as an alternative qualification option with both advantages and drawbacks, not as an easier or guaranteed approval.

Second, Non-QM loans should be used when they truly make sense, rather than as a universal solution. Sometimes, it is better for borrowers to wait and repair their profile – such as when they have minor credit issues or are close to meeting QM requirements for debt-to-income ratios or seasoning. This approach demonstrates a broker as a trusted advisor, rather than just a deal closer.

Last, but not least, partner with the right lender. Working with experienced Non-QM lenders, such as AD Mortgage, who offer clear guidelines, consistent underwriting, and strong communication can significantly improve approval outcomes and streamline the overall process.

Non-QM Programs at AD Mortgage

AD Mortgage is the Non-QM lender of choice with over 20 years of expertise in the mortgage industry. We offer our partners 10 tailored programs, flexible underwriting, broker-oriented tools, and 24/7 expert support.

The Non-QM loan programs offered by AD Mortgage include:

- DSCR: Credit for DSCR >1.25, no income and no employment needed, gift funds allowed – great for real estate investors.

- 12/24 Month Bank Statement: Loan amounts up to $4 million, DTI up to 55%, no tax returns required – great for self-employed individuals.

- ITIN: Loan amounts up to $1.5 million, primary residence and investment allowed – great for borrowers with an Individual Taxpayer Identification Number but who do not have a Social Security Number.

- Asset Utilization: Loan amounts up to $4 million, DTI up to 55%, gift funds allowed – great for self-employed, entrepreneurs, retirees, and those living off their investments.

FAQ

What is a Non-QM Loan?

A Non-QM loan is a type of mortgage that offers more flexible requirements than traditional mortgage lending, allowing a wider range of borrowers to qualify.

Is a Non-QM Loan the Same as a Subprime Loan?

No. Non-QM loans still require full underwriting and the borrower must demonstrate ability to repay (ATR). These loans are designed for borrowers who can afford the mortgage but do not meet traditional QM requirements – not for borrowers with poor credit.

Are Non-QM Loans Legal?

Yes. Non-QM loans are entirely legal in the U.S.

Do Non-QM Loans Require Income Verification?

Yes. Non-QM loans require verification of the borrower’s ability to repay, but lenders may allow alternative ways to demonstrate that ability. Instead of W-2s or tax returns used with QM loans, borrowers may qualify using bank statements, profit-and-loss statements, DSCR-based cash flow, or other documentation, depending on lender requirements.

Is it Harder to Qualify for a Non-QM Loan?

Non-QM loans are not necessarily harder to qualify for, but they do require careful preparation and the broker’s active involvement. A crucial factor is the lender’s expertise. Partnering with an experienced lender, such as AD Mortgage, improves the workflow and helps streamline deals.

Can Borrowers Refinance Out of a Non-QM Loan Later?

Yes. Borrowers can refinance out of a Non-QM loan into a conventional or QM loan to secure better rates or move to more stable terms.

Do Non-QM Loans Take Longer to Close?

Non-QM loans typically close within 30-60 days, which is similar to conventional but can take longer than QM depending on the lender, program, and borrower documentation.

Message our loan expert and get

Troubles with a scenario for a borrower?

a response in 30 minutes.