AD Mortgage

Grow your business

with our Fannie Mae and Freddie Mac

Conventional Standard and High Balance options!

Brokers have a variety of Conventional Loan options at their disposal for identifying the most suitable loan for their clients. Take your business to the next level by combining our fast turnaround times, innovative technology, and excellent service and support

Excellent program with flexibility such as rate buydowns and cancellable mortgage insurance

Perfect program for first-time homeowners with no geographical or income restrictions

Great Conventional option for low-middle income borrowers and allows gift funds for downpayments

An affordable mortgage option for low- to moderate-income individuals

See ProgramsA fit for homeowners seeking properties exceeding the standard limits

See ProgramsAD Mortgage has some of the best rates in the industry and is constantly adjusting to changing market conditions

More program options, more flexible eligibility requirements, and accounting for future property value in assessments are all benefits of private lenders

Fixed or ARM options are available to meet the strategic needs of borrowers

The higher CLTV improves eligibility for borrowers helping get loans approved and closed

Adding additional flexibility in addressing individual borrower needs

While higher than some programs the FICO threshold is attainable for many buyers and AD offers a range of other programs to suit different situations

Limits can reduce the range of properties borrowers can target, but AD has programs specifically designed for higher valued properties

Fannie and Freddie requirements can reduce eligibility and AD has programs in both Conventional and Non-QM to address these limitations

A lack of a large down payment affects many borrowers and AD’s FHA and Non-QM programs may be a good solution for such scenarios

“AD Mortgage's Conventional Loan programs are some of the best in the industry, providing borrowers with a variety of options to meet their individual needs. Our goal is to provide the necessary tools for our Partners to close deals and make homeownership

dreams a reality.”

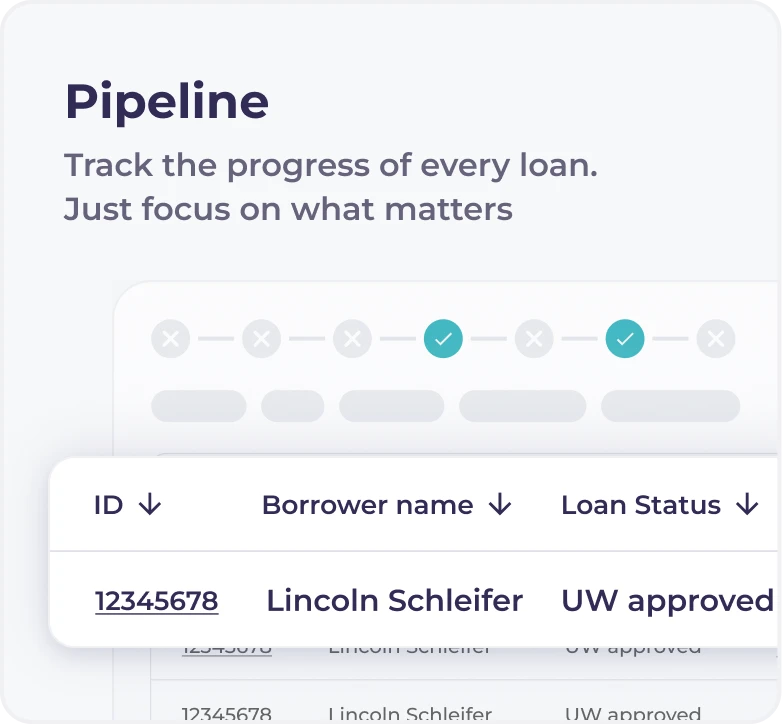

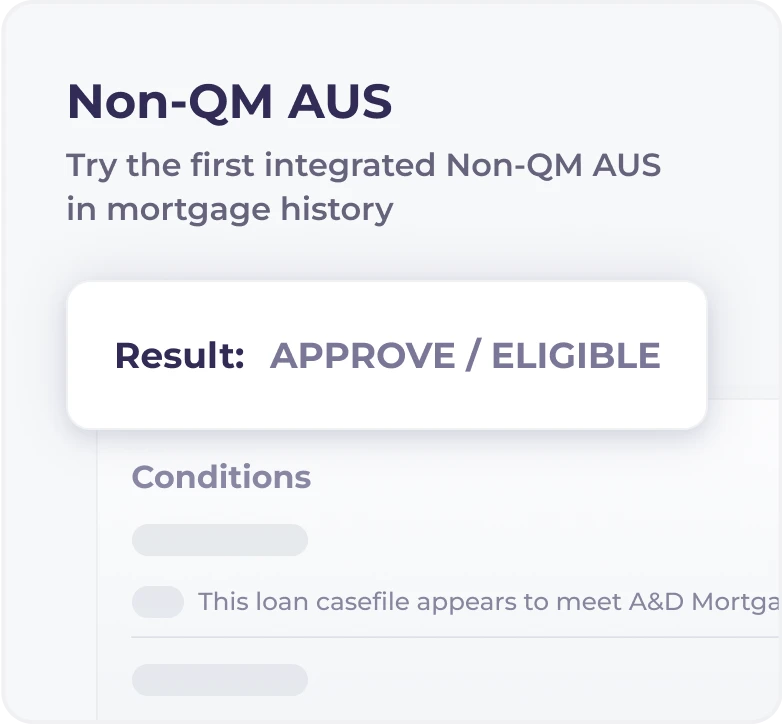

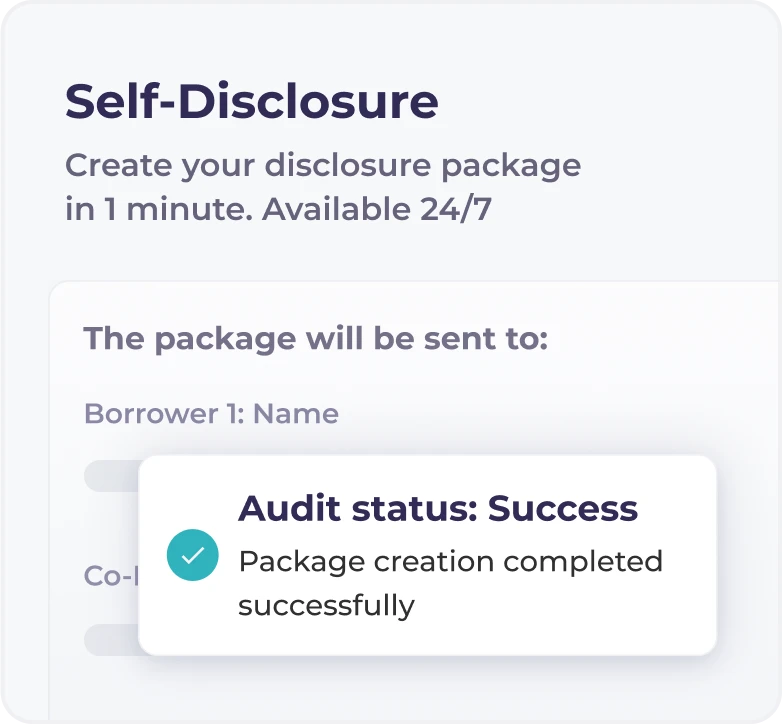

Leverage AIM — the Partner Portal with AI-powered features and tools for fast closings of Conventional loans

Take advantage of all the tools to streamline your workflow

Partner with AD Mortgage and utilized Conventional lending to propel your business forward. Our team understands your needs and will work diligently to help you succeed in the Conventional space

Tailored Conventional home

loans to meet the needs

of most borrowers.

Streamlined systems

and processes

designed to reduce time

start to finish.

Experienced Conventional

lending team focused on your needs.

Innovative leader actively

finding solution Conventional

mortgage space.

What is a conventional loan?

Conventional loans are not federally insured like FHA or VA loans. They are funded by private banks, credit unions, or other financial institutions and consequently have more stringent guidelines for approval such as larger down payments and higher credit scores. However, they have significant flexibility and can be used to fund the purchase of primary, secondary, and investment properties.

What are Fannie Mae and Freddie Mac?

Fannie Mae and Freddie Mac are Government Sponsored Enterprises (GSEs) that buy loans from lenders and then resell them in the Secondary Market as mortgage-backed securities (MSGs). The organizations have slightly different characteristics, but both were created to support US markets for home buyers. Borrowers will rarely, if ever, have any direct contact with either of these GSEs, but their existence ensures that there is plenty of money in the market to lend to home buyers, making obtaining and affording a mortgage possible in the US.

It is important to note that all Fannie Mae and Freddie Mac loans are conventional and conventional loans that meet Fannie and Freddie Mac requirements are often referred to as ‘conforming loans.’

What are interest rates for a conventional mortgage?

Conventional mortgage rates are constantly changing based on current economic conditions in the US and the rest of the world. The fluctuations year to year can be significant but changes usually occur incrementally. A borrower’s interest rate on a mortgage will also be affected by their credit score, down payment, and some other factors. Check with your broker or mortgage loan originator (MLO) for details on the available rates.

What is the difference between government loans like FHA and VA and Fannie Mae and Freddie Mac mortgages?

Federal Housing Administration (FHA) and Veterans Administration (VA) loans are guaranteed by the US government and have special conditions built into them to assist borrowers in getting financing. These conditions are especially attractive for first-time home buyers and those with minimal down payments and reserves. AD Mortgage provides many attractive options for FHA and VA loans.

Fannie Mae and Freddie Mac do not guarantee loans or assist borrowers with special conditions. Instead, these are Government Sponsored Enterprises (GSEs) that buy mortgages from lenders and then resell them to investors as Mortgage-Backed Securities (MBS). Borrowers and brokers will rarely, if ever, interact with either group; however, their existence in the market ensures that there are plenty of lenders and money available to homebuyers in the housing market.

How do I apply for a conventional loan with AD Mortgage?

Applying for a conventional loan with AD Mortgage is quick and easy. Your broker can help you complete the necessary information and get you moving in the right direction to securing funds and closing on your new home.

Why choose AD Mortgage for a Conventional loan?

Borrowers and brokers will both benefit from choosing AD Mortgage for their Conventional loan needs. AD offers 6 different loan programs including Fannie Mae, Freddie Mac, and refinance options for them, as well as their Standard and High Balance Conventional offers. Each program is designed to suit the individual needs of borrowers to allow them to secure funding. Additionally, AD provides very fast turnarounds on loan processing using state-of-the-art technology combined with excellent pricing.

What is the minimum down payment on a conventional loan?

3% is the minimum down payment for a conventional loan. However, mortgage insurance will be required until the loan to value ratio (LTV%) reaches 80% or less on the mortgage. AD Mortgage has six different conventional mortgage options available to borrowers. For example, if a home’s value is $200,000 and the balance on the mortgage is above 80% ($160,000), then mortgage insurance will be required. In this case, once the balance on the mortgage reaches $160,000 or less, mortgage insurance will no longer be required.

Are conventional loans better than FHA loans?

It is better to consider the differences in these two types of loans as ‘not better, not worse, just different’. Both types of loans provide various options that may be better suited to different borrowers based on their individual circumstances. For example, a first-time home buyer with only a small down payment may be able to obtain an FHA loan although they don’t qualify for a conventional mortgage. Conversely, a family looking to buy a second home or investment property would be better suited with a conventional loan since FHA loans are only for primary residences. There are other factors that differentiate between these loan programs as well. You can compare them in the AD Mortgage Programs page.

What is the minimum FICO score to get a conventional mortgage?

The minimum FICO score for qualifying for a conventional loan is 620 and AD Mortgage has several conventional mortgages to meet the needs of borrowers that meet the 620 FICO minimum. However, borrowers with lower scores may be eligible for other mortgages such as FHA or VA loans, which AD Mortgage also has available.

Do conventional mortgages have better rates than other loans?

Yes and No. Borrowers are often much different than one another, and every mortgage has its own circumstances, which may vary widely. In many cases, a larger down payment and better credit score will qualify you for a conventional mortgage with a lower interest rate, but sometimes an FHA program may provide a lower rate.

These variances are why working with a Mortgage Loan Originator or broker to identify the best individual option is important. Fortunately, AD Mortgage has many mortgage programs to meet most borrowers’ needs.

Is it harder to get a conventional loan?

Conventional mortgages are more difficult than many other loan programs for some homebuyers since the minimum FICO score is 620 and down payment minimums are higher. However, borrowers with good credit and the necessary down payment will find the process very streamlined, especially at AD Mortgage with its incredibly fast turnaround times.

If I don’t qualify for Fannie or Freddie Mac, can I still get a conventional mortgage?

In many cases, you may qualify for another conventional mortgage even if you don’t meet the Fannie Mae and Freddie Mac criteria. It is also possible that you will qualify for other mortgage programs offered by AD Mortgage that best suit your individual needs and circumstances. Discuss these options with your broker to decide what is best in your situation.

Is a ‘conv’ mortgage different than a conventional mortgage?

A ‘conv’ mortgage usually refers to an abbreviated version of ‘conventional’.

Do I need mortgage insurance for a conventional mortgage?

Conventional mortgages require mortgage insurance on loans with a combined loan-to-value ratio (LTV) of 80% or more. However, once a conventional mortgage reaches 20% in equity, the mortgage insurance can be removed from the loan.

Struggling with a Scenario?

Will Help in 30 Minutes!