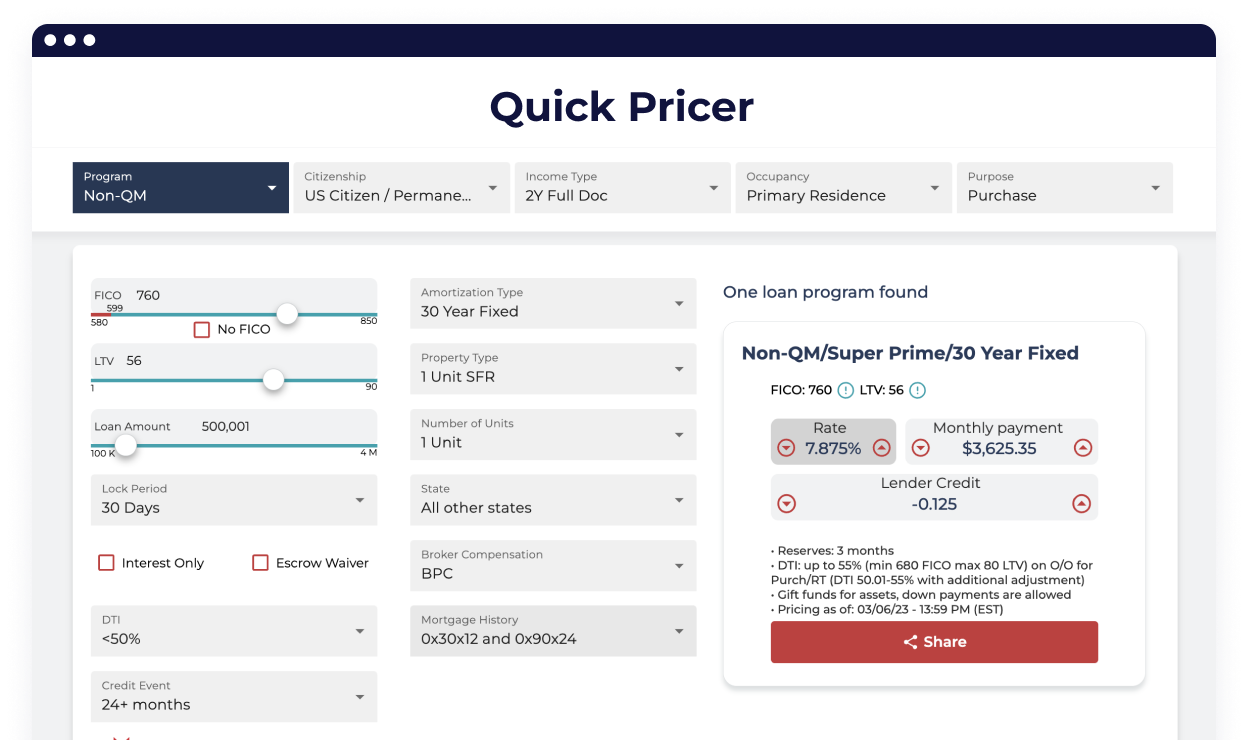

Loan amounts up to $4 million

DTI up to 55% on owner-occupied

Min. 3 months of reserves

Min. FICO 620 or no score

Up to 90% СLTV purchase / Up to 80% СLTV cash-out

Owner-occupied, second home, and investment properties

Max cash-in-hand $500,000 for CLTV >65%, $1,000,000 for CLTV ≤65% to ≥55%, no max cash-in-hand limitation for CLTV <55%

2 or 1 year traditional full documentation income

Gift funds are allowed (borrower contribution required under 80% CLTV: OO - 0%, Inv - 10%; over 80% CLTV: OO - 5%, Inv - NA) for down payment, closing costs, and reserves

Mortgage history: 0x30x12 and 0x90x24 for Super Prime, 0x60x12 for Prime

Min. 12 months out of credit event

Eligible property types: SFR, townhomes, condo warrantable/non-warrantable, condotel, 2-4 units (not available for 2nd home), PUD, SFR rural, short-term rentals, leasehold

Eligible terms: 30 & 40-year fixed, 5/6 & 7/6 ARM

120 months of I/O period, 240/360 months of amortization, qualified at amortized PITIA payment after I/O period, IO product not allowed in IL and NM

Eligible citizenship: US citizenship, Permanent & Non-Permanent Resident, ITIN

Eligible borrowers: Individuals, LLCs/Corp without a hit