The mortgage industry continues to advance with the latest technologies, and AD Mortgage is helping lead the way. The Non-QM AUS is the latest brainchild of AD Mortgage, designed by mortgage experts.

By combining cutting-edge automation with in-depth mortgage expertise, the system enables faster decisions and empowers brokers to serve a broader range of borrowers with confidence. Watch the video about Non-QM AUS right now and learn more about the tool right here.

What Is Non-QM AUS by AD Mortgage?

AD Mortgage’s Non-QM AUS (Automated Underwriting System) is a cutting-edge technology that streamlines and automates the underwriting process for non-qualified mortgage (Non-QM) loans. This system is tailored specifically for borrowers with unique financial situation–such as self-employed individuals, real estate investors, or those with non-traditional income documentation.

Non-QM AUS: Key Features

- Real-Time Loan Decisions. Immediate “Approve Eligible” responses based on Non-QM criteria.

- Automated Conditions. System-generated conditions to speed up processing.

- AI-Driven. Human error-free. Plus, it ensures uniformity in underwriting.

- Integrated into AIM Portal. One-click access through AD Mortgage’s AIM Partner Portal.

- Intuitive Interface. Easy to use and navigate, minimizes friction and wasted time.

- Covers a Variety of Programs. Supports DSCR, ITIN, 1099, Asset Utilization, WVOE, and more.

How to Start Using the Non-QM AUS? | 3 Step Guide

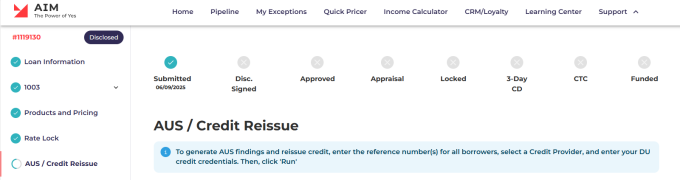

- Step 1. Become an Approved Partner. If you’re not an AD Mortgage partner yet, register as a partner. Visit the Broker Package page and complete the registration form. Source: AIM Partner Portal

- Step 2. Create a Loan Application. Log in to the AIM Partner Portal and start a new loan application by completing the 1003 form. Select a Non-QM loan product that matches your client’s needs.

- Step 3. Run the Non-QM AUS. Go to the ‘AUS / Credit Reissue’ section in the loan application. Here, you can run the Non-QM AUS to receive a provisional pre-approval decision, typically within 5 minutes.

Why Does It Matter for Your Business?

This innovative tool empowers mortgage professionals to close Non-QM deals faster and with better accuracy – improving the borrower’s experience and the broker’s productivity.

Step into the future of Non-QM lending and meet today’s diverse lending needs like a seasoned professional. Go to Non-QM AUS: Meet the Mortgage Milestone right away.

What Other Technologies Are Available?

AD Mortgage always keeps up with the times and offers the latest tools to boost all your business processes.

There more set of tools coming soon. As CEO Max Slyusarchuk pointed out, “This launch is just the beginning. We have a multi-year roadmap for the development of this service, which will allow us to create an even more fantastic product. But even now, it will save a lot of time and effort for our partners.”

More great services and tools to explore:

- AIM Partner Portal. An all-in-one platform for submitting, tracking, and managing loans.

- Quick Pricer. An instant pricing engine that gives brokers accurate loan estimates in seconds.

- Free LEADer CRM. An award-winning customer relationship management platform.

Innovation starts here. Experience the future of Non-QM mortgage solutions.

FAQ

- What is AD Mortgage’s Non-QM Automated Underwriting System (AUS)?

It is an AI-driven platform designed to instantly assess borrower eligibility and pricing for Non-QM loans. - How does the Non-QM AUS benefit mortgage brokers?

It helps mortgage brokers save time by providing instant pre-qualification, income analysis, and decision-making without a manual underwriter. - Which Non-QM loan types are supported?

The AUS supports various Non-QM loan types, including ITIN, DSCR, Asset Utilization, 1099 income, and other programs. - Is the Non-QM AUS accessible to all brokers?

The Non-QM AUS is accessible only for the approved brokers registered with AD Mortgage. - What makes this AUS different from traditional systems?

Unlike traditional AUS platforms focused on agency loans, this system is tailored specifically for Non-QM criteria and alternative documentation. - How can I get started with the Non-QM AUS?

You can get started by registering with AD Mortgage and accessing the AUS through the AIM Partner Portal.