In our continuous effort to enhance the efficiency and accessibility of our loan programs, we’re happy to lead with a significant update that marks a substantial improvement in our lending process. This major Non-QM update will facilitate your work and accelerate the path to loan closure for many of your clients.

Major Update

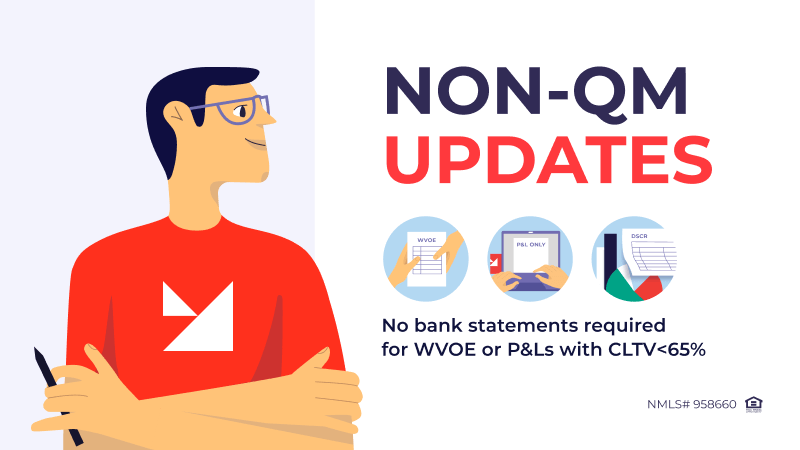

Simplified Documentation for WVOE and P&L Loans

Choose a top nationwide lender that cares about your growth!

Get StartedEffective immediately, for Wage Verification of Employment (WVOE) and Profit & Loss (P&L) loans with a Combined Loan-to-Value (CLTV) ratio below 65%, we are removing the requirement for bank statements. This pivotal change will streamline the application process, significantly reducing paperwork, and expediting the overall loan approval timeline. It reflects our commitment to making lending more accessible and less cumbersome for both mortgage brokers and borrowers alike.

Additional Non-QM Loan Program Enhancements

DSCR Loan Eligibility Expansion

Borrowers seeking a DSCR loan will now have to own a property in the United States. For Foreign National DSCR loans, property ownership in any country within the past 36 months is necessary. This adjustment broadens the eligibility net, making it easier for investors and foreign nationals to secure financing.

Prepayment Penalty Adjustments in OH and VT

We’ve fine-tuned the prepayment penalty terms for loans on 1-2 unit properties in Ohio and Vermont, ensuring more attractive and competitive loan products for borrowers in these states.

Interest-Only Option Update for CEMA Loans in NY

Please note that going forward, the interest-only payment option will not be available for CEMA loans in New York. This change aligns with regulatory standards and market demands, ensuring compliance and borrower well-being.

Ownership Changes for LLCs and Corporations

Looking for a suitable loan program?

Choose among 20+ programs and get

a detailed loan calculation

Significant ownership changes in an LLC or Corporation involved in a refinance will be treated as a Quit Claim Deed and limited to a 65% CLTV. This policy is instituted to maintain clarity and stability in property ownership and valuations.

We are confident that these program updates, particularly the elimination of bank statement requirements for certain loans, will empower you to serve your clients more effectively. It will reduce barriers and foster a smoother and faster loan acquisition process.