3.5-minute read

When it comes to obtaining a mortgage, understanding credit scores is essential. A credit score is a numerical representation of an individual’s creditworthiness and plays a significant role in the mortgage approval process. As a mortgage broker, it is crucial to have a comprehensive understanding of credit scores and their impact on mortgage approvals. In this blog post, we will explore the importance of credit scores, how they are calculated, and the ways in which they influence mortgage approvals.

1. What is a Credit Score?

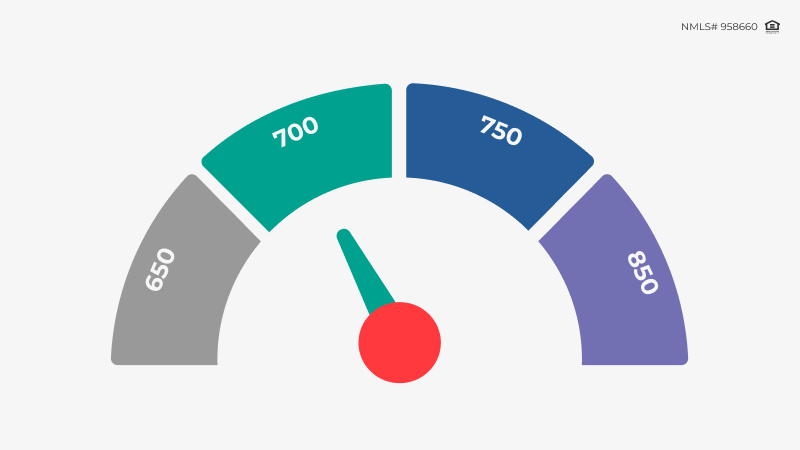

A credit score is a three-digit number that reflects an individual’s creditworthiness based on their credit history. It is calculated using information from credit reports, including payment history, credit utilization, length of credit history, credit mix, and new credit inquiries. The most commonly used credit scoring models are FICO® scores and VantageScore®.

2. The Importance of Credit Scores in Mortgage Approvals

Credit scores are a key factor in mortgage approvals as they provide lenders with an assessment of a borrower’s credit risk. Lenders use credit scores to determine the interest rate, loan amount, and overall terms offered to borrowers. A higher credit score generally translates to more favorable loan terms, while a lower credit score may result in higher interest rates or even loan denial.

3. Credit Score Requirements for Mortgage Loans

Different mortgage programs have varying credit score requirements. Conventional loans typically require a minimum credit score of 620 or higher, while government-backed loans, such as FHA loans, may have more lenient requirements, often allowing borrowers with credit scores as low as 580 to qualify. However, it’s important to note that higher credit scores generally result in better loan options and lower interest rates.

4. Factors that Influence Credit Scores

Understanding the factors that impact credit scores can help borrowers improve their scores and increase their chances of mortgage approval. Key factors include:

- Payment History: The timeliness of bill payments, including credit card payments, loans, and other debts, has a significant impact on credit scores. Consistently making on-time payments is crucial for maintaining a positive credit history.

- Credit Utilization: This refers to the percentage of available credit that a borrower is currently using. Keeping credit utilization below 30% is generally recommended to maintain a healthy credit score.

- Length of Credit History: The length of time a borrower has held credit accounts influences credit scores. Having a longer credit history demonstrates responsible credit management and can positively impact scores.

- Credit Mix: Having a diverse mix of credit accounts, such as credit cards, loans, and a mortgage, can positively impact credit scores. It shows a borrower’s ability to manage different types of credit responsibly.

- New Credit Inquiries: Opening multiple new credit accounts within a short period can negatively impact credit scores. Each credit inquiry generates a “hard inquiry” on the credit report, which may indicate higher credit risk to lenders.

5. Strategies for Improving Credit Scores

For borrowers with lower credit scores, taking steps to improve their creditworthiness can increase their chances of mortgage approval and better loan terms. Strategies include:

- Making Timely Payments: Paying bills on time consistently is essential for improving credit scores. Set up automatic payments or reminders to ensure timely payments.

- Reducing Credit Utilization: Paying down outstanding debts and keeping credit utilization below 30% can positively impact credit scores.

- Reviewing and Disputing Errors: Regularly review credit reports for any inaccuracies or errors. Dispute any incorrect information to have it removed from the credit report.

- Building a Positive Credit History: Responsible credit management over time, including keeping credit accounts open and active, can help build a positive credit history and improve credit scores. This may involve using credit cards responsibly, making regular payments, and avoiding excessive debt.

- Limiting New Credit Inquiries: Minimize the number of new credit applications to reduce the impact on credit scores. Be cautious when opening new accounts and only apply for credit when necessary.

6. Working with Borrowers with Challenged Credit

As a mortgage broker, you may encounter clients with challenged credit histories. In these cases, it’s essential to provide guidance and solutions tailored to their specific situation. This may include exploring alternative loan programs, such as FHA loans, which have more flexible credit requirements. Additionally, educating clients about credit improvement strategies can empower them to take steps towards improving their creditworthiness.

7. The Role of Mortgage Brokers in Credit Score Education

Mortgage brokers play a crucial role in educating clients about credit scores and their impact on mortgage approvals. By providing clear explanations of credit scoring factors, offering credit improvement advice, and connecting clients with resources such as credit counseling services, you can empower borrowers to take control of their financial future.

Struggling with a loan scenario? Get a solution in 30 minutes!

Fill out the short form and get a call from our AE

Submit Scenario

Conclusion

Understanding credit scores and their influence on mortgage approvals is vital for mortgage brokers. Credit scores serve as a measure of creditworthiness and play a significant role in determining loan terms, interest rates, and loan eligibility. By educating clients about credit scores, providing guidance on credit improvement strategies, and offering tailored solutions for borrowers with challenged credit, mortgage brokers can assist clients in achieving their homeownership goals. Remember, an informed borrower is better equipped to make responsible financial decisions and navigate the mortgage process successfully.

As a mortgage broker, your clients rely on your expertise to find them the best deals. Our Quick Pricer tool can be an invaluable asset in your quest to secure the most advantageous mortgage rates. Be sure to explore our Programs section for additional resources tailored to your needs. If you have specific scenarios in mind, don’t hesitate to request them; we’re here to assist you. And if you’re interested in joining forces to provide even more value to your clients, consider becoming a partner with us. Together, we can empower individuals and families to achieve their dreams of homeownership.